Blogs » Society » Media Markt Closing (For Real this Time)

Blogs » Society » Media Markt Closing (For Real this Time) |

- Media Markt Closing (For Real this Time)

- Victims of Egypt hot air balloon crash left without compensation

- Use of 'gutter' oil lands restaurant owners in jail

- Watch: Bringing basketball to North Korea (before Dennis Rodman)

- This Week in Shanghai Sports

- Weekendist: Mar 1-3, Butch Bradley, Trippple Nippple, and more!

- Product Testing Labs In China

- Qian Qiu Xiao Guan: A Taste of Taipei

- Infographic: The numbers behind the Great Firewall of China

- The Glory of Imperial Russia

- China Shutters 225 Websites And More Than 30,000 Microblogs For “Obscene Content,” But Not PornHub

- Ai Weiwei Is Bored: Here He Is In His Beijing Studio (Pictures By Jamie Hawkesworth)

- Teenager Poops In Guangzhou Subway Trash Receptacle

- Why Yes, In China, There Is A Corporate Training Industry To Teach Working Girls How To Snare You Using Social Apps

- Here’s A Picture Of A Young Kim Jong-Un Wearing A Dennis Rodman Bulls Jersey

- China’s Navy Gets Its First Stealth Frigate

- Natural capital: avoiding the next financial crisis

- Young NPC delegate has no idea what she's supposed to be doing, neither do we

- Mo Yan gives first interview since winning Nobel Prize for Literature

- Shanghai traffic cops given anti-smog nose plugs

| Media Markt Closing (For Real this Time) Posted: 28 Feb 2013 08:43 PM PST |

| Victims of Egypt hot air balloon crash left without compensation Posted: 28 Feb 2013 09:00 PM PST |

| Use of 'gutter' oil lands restaurant owners in jail Posted: 28 Feb 2013 08:00 PM PST  Two restaurants owners in Shanghai received prison sentences of three and a half years, and 200,000 yuan each in fines for reusing cooking oil this week. Two employees also received prison sentences and fines of lesser severity. [ more › ] Two restaurants owners in Shanghai received prison sentences of three and a half years, and 200,000 yuan each in fines for reusing cooking oil this week. Two employees also received prison sentences and fines of lesser severity. [ more › ]     |

| Watch: Bringing basketball to North Korea (before Dennis Rodman) Posted: 28 Feb 2013 07:00 PM PST Koryo Tours (previously) point out that despite Dennis Rodman's much vaunted basketball diplomacy, they were the first to bring American players to the DPRK. Koryo took US players and coaches to two schools, to play against and train North Korean kids, as you can see in the above video. [ more › ]     |

| Posted: 28 Feb 2013 06:27 PM PST Date: Mar 1st 2013 9:27a.m. NFL stars make their way to Shanghai for American Football Without Barriers |

| Weekendist: Mar 1-3, Butch Bradley, Trippple Nippple, and more! Posted: 28 Feb 2013 06:00 PM PST  It's time to have a night on the town: stand-up comedy with Butch Bradley, dance to Dicky Trisco disco, marvel at Trippple Nippple insanity - you make the choice. On Saturday, we continue with the Toxic Avenger at Arkham and Sub-Culture's first big 2013 event. And since every weekend has only three nights that want to be used, we recommend paying 390 a visit for the screenig of a punk biopic, free beer and live music. And if that's still not enough, head over to our calendar for more. [ more › ] It's time to have a night on the town: stand-up comedy with Butch Bradley, dance to Dicky Trisco disco, marvel at Trippple Nippple insanity - you make the choice. On Saturday, we continue with the Toxic Avenger at Arkham and Sub-Culture's first big 2013 event. And since every weekend has only three nights that want to be used, we recommend paying 390 a visit for the screenig of a punk biopic, free beer and live music. And if that's still not enough, head over to our calendar for more. [ more › ]     |

| Posted: 28 Feb 2013 06:09 PM PST Very helpful post over at the always very helpful Quality Inspection Tips blog, entitled, "List of the big testing laboratories in China." The post sets out a list of product testing labs in China, with all sorts of contact information and personnell names. If you are involved in manufacturing in China, this list will likely prove quite useful to you and I recommend you go read it. |

| Qian Qiu Xiao Guan: A Taste of Taipei Posted: 28 Feb 2013 05:25 PM PST |

| Infographic: The numbers behind the Great Firewall of China Posted: 28 Feb 2013 05:00 PM PST  The Great Firewall of China might be loathed by pretty much everyone, but one can't deny that it can be pretty effective. This infographic, from Background Check, explains how the firewall actually functions. [ more › ] The Great Firewall of China might be loathed by pretty much everyone, but one can't deny that it can be pretty effective. This infographic, from Background Check, explains how the firewall actually functions. [ more › ]     |

| Posted: 27 Feb 2013 05:00 PM PST

This posting includes an audio/video/photo media file: Download Now |

| China Shutters 225 Websites And More Than 30,000 Microblogs For “Obscene Content,” But Not PornHub Posted: 28 Feb 2013 01:44 AM PST China ostensibly hates porn — hates it with a passion and hates it despite reason – but its state news organization links to it and — as the running joke with us goes — one particular porn site, the 39th most popular in the US, remains unblocked. To clarify: that's 39th most popular website, not just porn site, and 65th most popular website in the world. PornHub. Through thick, thin, and Internet nukeage, it has remained unblocked, like a cockroach, never to be eliminated. So it is that when we saw Xinhua's latest announcement that China's relevant ministries recently terminated 225 websites and more than 30,000 microblogs that distributed "obscene content" — culled from more than 79,000 tips — we wondered: is PornHub still there? The answer is yes. There's a lovely gif on the right sidebar, too. Please don't visit if you're in an office… …unless, that is, your office is the one that was assigned to assess those 79,000 user-sent tips. For anyone — and I mean anyone — that's a lot of porn to look at. Does one get desensitized? Does it basically ruin your chance of keeping a normal sex life? I don't know. But good job, Ministry of Industry and Information Technology and Ministry of Public Security. China is such a safer place thanks to your due diligence. PORNHUB. |

| Ai Weiwei Is Bored: Here He Is In His Beijing Studio (Pictures By Jamie Hawkesworth) Posted: 27 Feb 2013 10:44 PM PST The outspoken agitator you know as Ai Weiwei — who, last we checked, is still not allowed to leave the country — might be weary and beat down (or just mugging for the camera), judging by these pictures by Jamie Hawkesworth, who recently visited the artist in his Beijing studio, commissioned by the magazine AnOther. As Rob Alderson writes on It's Nice That:

We're not the biggest champions of Ai Weiwei's work, but the artist is indeed a valuable lodestone, and it's for the greater good that he attracts such outstanding fellow artists. The "Ai Weiwei as caged bird" metaphor can't be clearer in this following shot, among others over at the It's Nice That website: Jamie Hawkesworth's stunning studio visit shots of Ai Weiwei for AnOther are superb (It's Nice That, h/t Alicia via Hypebeast) |

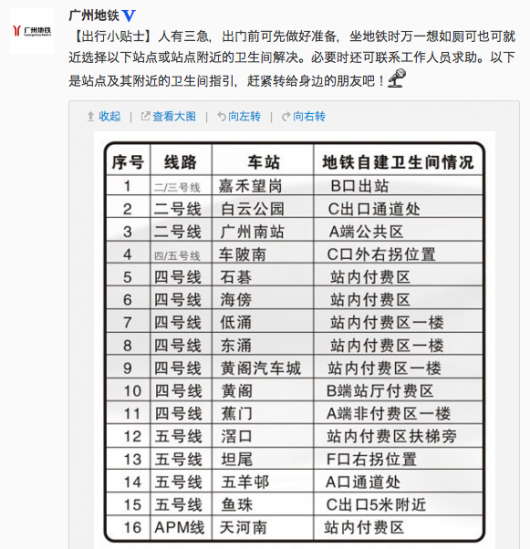

| Teenager Poops In Guangzhou Subway Trash Receptacle Posted: 27 Feb 2013 09:01 PM PST This raises a very, very important question: does poop really belong in the "recyclable" side of the trash bin? Biodegradable isn't the same as recyclable, is it? At least he's not doing it inside a subway carriage. (Sina Weibo user @粤语最盏鬼, h/t Will Crook) UPDATE, 7:28 pm: Mr. Crook sends this along: it appears that Guangzhou Metro has posted on its official Sina Weibo account the locations of bathrooms throughout the subway network. "Hurry and pass this to your nearby friends," it writes. It manages to avoid all mentions of what's happening in the picture above. Well played, Guangzhou Metro. |

| Posted: 27 Feb 2013 08:32 PM PST Those who use Momo and, to a lesser extent (but not much lesser), WeChat probably already know this, but social Apps are great for finding new and — how shall we say — temporary friends. However, if you are cruising around in the great murky sea trawling for bottles or booty, you open yourself up to getting hooked, too. Really open yourself up, actually, because you're going up against professionals. As if you needed confirmation that prostitutes are on social Apps to lure clients, please turn your attention to the above video, found by The Nanfang, in which working girls sit in on a lecture on this very subject. "Everybody wants to get more clients, get more tips," says the bespectacled lecturer, her curly hair tied into a ponytail to make her the spitting of every matronly "teacher" you've seen in pornos. "You can find the answer through our marketing method. Today, I want to tell everybody the reality…" It turns into a pep talk about the ease with which girls can break the profit ceiling by using Momo, WeChat and Weibo. (We wish Jim Boyce's Momo party had been like this.) "Really, it's all very easy!" says the lecturer. She turns toward a TV screen that shows a woman's profile and proceeds to assess it. A couple of women in the class begin whispering and giggling, but mostly everyone pays close attention. Men out there: you have no chance. Watch: Prostitutes in China get a lesson in using Momo, WeChat to lure clients (The Nanfang) |

| Here’s A Picture Of A Young Kim Jong-Un Wearing A Dennis Rodman Bulls Jersey Posted: 27 Feb 2013 07:14 PM PST Pictured above, flagged by Gawker via Daily NK, is Kim Jong-un, the dictator as a young man during his days at a Swiss boarding school. How exceptionally notable is it that from a team with Michael Jordan and Scottie Pippen, he chose to don the No. 91 jersey belonging to Dennis Rodman? We're reminded of this AP report back in 2009: "A classmate recalled him as timid and introverted but an avid skier and basketball player who was a big fan of the NBA star Michael Jordan." Ah, so maybe Kim was just a sports hipster? Whatever the case, here's your reminder that Dennis Rodman — The Worm, The Weird One — is currently in North Korea with VICE and, in all likelihood, killing it. You can follow his adventures at the hashtag #WORMinNorthKorea. We can't wait for his sit-down with the man — now all grown up — pictured above: |

| China’s Navy Gets Its First Stealth Frigate Posted: 28 Feb 2013 09:31 AM PST The PLA-Navy has taken delivery of the first of 20 Type 056 frigates (above). They are called stealth frigates because of their ability to evade radar detection thanks to a sleek design and some of the same technology that goes … Continue reading → |

| Natural capital: avoiding the next financial crisis Posted: 27 Feb 2013 11:55 PM PST Earth's ecosystems are the foundations of our economy, but rarely appear in balance sheets. That means risks for markets Nature underpins global wealth creation. The renewable flow of goods and services provided by the earth's ecosystems buttress our economy and yield benefits for business. But this stock of ecosystems – also known as "natural capital" – is largely invisible in financial decision-making. As a result, natural capital does not appear on the balance sheets of businesses and is largely unaccounted for in financial products. |

| Young NPC delegate has no idea what she's supposed to be doing, neither do we Posted: 28 Feb 2013 05:00 AM PST  One of the youngest members of the National People's Congress has inadvertently highlighted the pointlessness of the very institution she belongs to after she admitted she had to do research online to work out what the hell she was supposed to be doing at the annual meeting of the NPC which takes place in Beijing next week. [ more › ] One of the youngest members of the National People's Congress has inadvertently highlighted the pointlessness of the very institution she belongs to after she admitted she had to do research online to work out what the hell she was supposed to be doing at the annual meeting of the NPC which takes place in Beijing next week. [ more › ]     |

| Mo Yan gives first interview since winning Nobel Prize for Literature Posted: 28 Feb 2013 04:00 AM PST  Mo Yan, winner of the 2012 Nobel Prize for Literature, has been subject to much criticism over his perceived cosiness with the Chinese government. In his first interview since becoming a Nobel laureate, Mo spoke to Der Spiegel about politics, writing, and Ai Weiwei. [ more › ] Mo Yan, winner of the 2012 Nobel Prize for Literature, has been subject to much criticism over his perceived cosiness with the Chinese government. In his first interview since becoming a Nobel laureate, Mo spoke to Der Spiegel about politics, writing, and Ai Weiwei. [ more › ]     |

| Shanghai traffic cops given anti-smog nose plugs Posted: 28 Feb 2013 03:00 AM PST  In an attempt to protect its officers from the sweet, cancerous smell of PM2.5 smog, Shanghai's Songjiang district has begun equipping its police force with hilarious purple nasal filters. Unlike the classic pollution masks worn by most air-quality conscious citizens, nasal plugs still allow police officers to blow whistles and shout (presumably while sounding as though they have severe congestion). [ more › ] In an attempt to protect its officers from the sweet, cancerous smell of PM2.5 smog, Shanghai's Songjiang district has begun equipping its police force with hilarious purple nasal filters. Unlike the classic pollution masks worn by most air-quality conscious citizens, nasal plugs still allow police officers to blow whistles and shout (presumably while sounding as though they have severe congestion). [ more › ]     |

| You are subscribed to email updates from Update » Blogs » Society To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Video has emerged (below) of the horrifying final seconds of the fated Luxor hot air balloon ride in Egypt. Compounding the grief, the SCMP

Video has emerged (below) of the horrifying final seconds of the fated Luxor hot air balloon ride in Egypt. Compounding the grief, the SCMP

Comments